India’s Consumer Durables Sector: A Growth Powerhouse for Investors

India’s consumer durables market is projected to reach $60 billion by FY30, cementing its position as the fourth-largest globally by 2027, according to the Confederation of Indian Industry (CII). This rapid growth trajectory underscores the country’s emergence as a global manufacturing hub and offers robust opportunities for investors.

The sector is set to benefit from significant advancements in manufacturing capabilities and the development of an indigenous component ecosystem. Government initiatives, such as the Production-Linked Incentive (PLI) scheme, have further bolstered its competitiveness. With over $500 billion in foreign direct investment and the creation of 850,000 jobs, the consumer durables sector exemplifies the potential of India’s manufacturing renaissance.

Investment Implications: Capitalizing on India’s Consumer Growth

India’s booming consumer market is a key driver behind Chartis Asset Management’s inclusion of the Columbia India Consumer ETF in its portfolio. The ETF focuses on consumer discretionary and staple sectors—autos, food products, beverages, and household goods—set to benefit from India’s rising per capita consumption.

This aligns with Chartis’ broader investment philosophy, which emphasizes value investing and capitalizing on cyclical market inefficiencies. India’s projected population growth of 82 million new working-age citizens by 2030 further highlights the long-term growth potential of its consumer market.

Strengthening India’s Quality Ecosystem

The sector is making steady progress toward aligning its products with global quality benchmarks. Building a robust quality ecosystem and adopting standardization are essential not only to meet global reliability standards but also to establish India’s reputation as a key exporter of quality products. These efforts align with the government’s vision of making Indian manufacturing a cornerstone of global supply chains.

Emerging Opportunities in Real Estate and Manufacturing

India’s real estate sector, driven by favorable demographics and economic growth, complements the growth in consumer durables. According to Bloomberg Intelligence, India’s property markets are poised to outperform their Asia-Pacific counterparts, benefiting from stable politics, infrastructure development, and strong employment growth.

Moreover, the manufacturing sector continues to attract significant investment, supported by subsidies and free trade agreements. These developments reflect the strategic positioning of India as a key player in the global manufacturing and trade ecosystem.

Innovation and R&D: The Next Frontier

Technological advancements, particularly in artificial intelligence (AI), are redefining the consumer durables sector. Companies investing in R&D to integrate such innovations stand to unlock new market applications and sustain their competitive edge. This focus on innovation aligns with Chartis’ investment strategy, which prioritizes businesses with strong growth potential and technological adaptability.

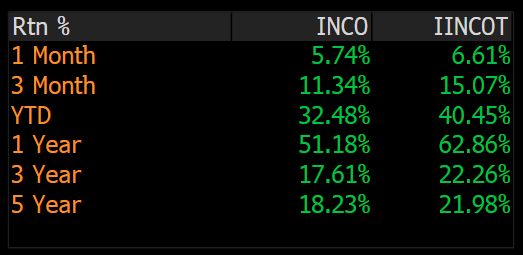

The Funds Performance

The fund compared to the MSCI South African Index, returns in $: